As the 2023 results show, the games market is very promising and actively developing, with growth in both profitability and the number of players. However, game development, especially for high-budget AAA projects, is a long and labour-intensive process: the more expensive and technically complex the games become, the longer the development cycle. In an environment where every project initiated becomes a long-term commitment, it is impossible to adjust business strategy on the fly. As a result, many market players rely on expert forecasts to help them make the right choices. Last year was relatively successful for the industry. Let’s see if the experts think this trend will continue in 2024.

Gaming market revenues

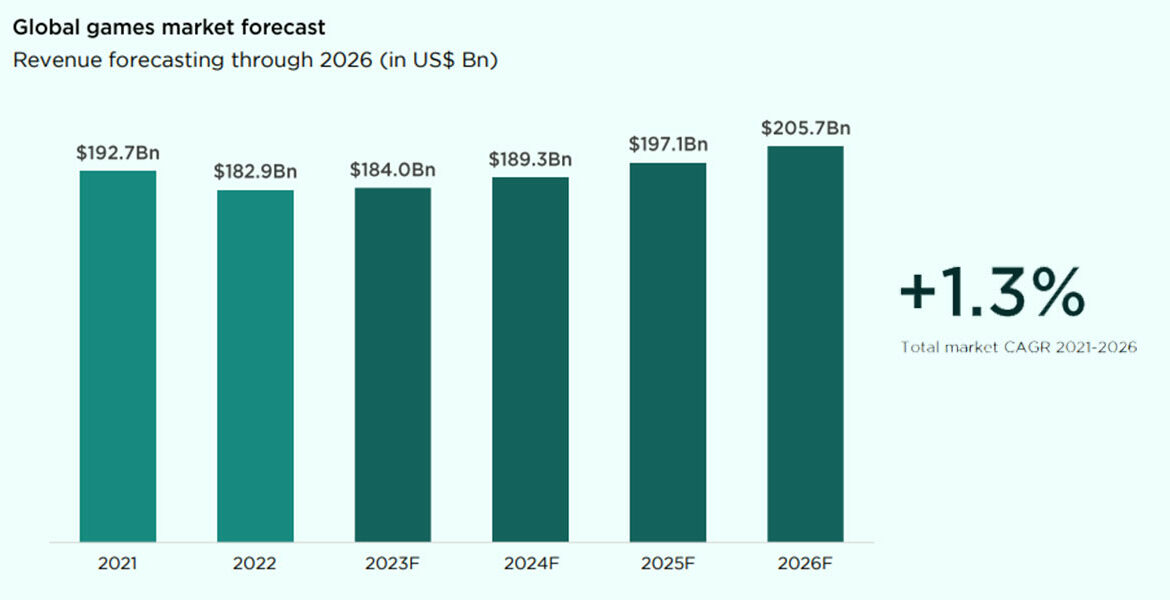

According to Newzoo forecasts, the gaming market will generate revenues of USD 189.3 billion in 2024 (USD 184.0 billion in 2023). For the next two years, experts predict a stable growth rate of around USD 8 billion per year (up to USD 197.1 billion in 2025 and USD 205.7 billion in 2026), which is higher than the growth in 2023 compared to 2022. Revenues in 2025 would thus exceed the 2021 figure ($192.7 billion), which was the highest (in the pandemic wave) in the last 3 years.

PCs and consoles

The future looks bright for this market segment. After a downturn in 2022, profitability picked up in 2023 and experts expect this trend to continue in 2024.

Mark Reger, senior director of business development at Steer Studios (Savvy Games Group), believes the games industry has a lot in store for 2024. He predicts an increase in the number of multiplayer games that emphasise social interaction between users (both PvE and PvP projects), and also believes that games will feature more player-created content that players are willing to share with the community.

Romain Bingler, responsible for market strategy at Ubisoft, believes that 2024 will be a year of stabilisation: the industry will be able to avoid significant fluctuations and deviations. He also believes that there will be challenges, but also new opportunities for market players.

André Persson, head of Project 369 Group, also points to the “post-pandemic shaking” of the industry: studios are closing, game companies are laying off staff, but new studios are emerging, which means that the market still offers attractive opportunities. In addition, investors have become more cautious, which André Persson believes will increase the demand for research and expertise in this area.

One of the growth drivers in the PC and console segment will be the increasing number of owners of current generation consoles – the Xbox series X/S and PlayStation 5. The list of releases planned for 2024 is less impressive than last year. Nevertheless, game services and sales of previously released titles are expected to generate significant revenues.

Nostalgia game

According to the Newzoo survey, most experts agree that game companies will be reluctant to take financial risks, so there will be few new IPs. Instead, the bet will be on sequels to established franchises. There will be all sorts of reimaginings, like last year’s Assassin’s Creed Mirage, which was positioned as a return to the series’ roots: the game was much smaller in scale than recent projects about the Unseen, more reminiscent of the first parts of the series. The developers played on the nostalgia of fans of the franchise, and this approach will be widely used in the coming year, including the release of remakes of popular games from the past. Experts also believe that companies will increasingly begin to abandon the free-to-play distribution model (free games with in-game purchases) in favour of paid games (according to 2023 data, players are more likely to choose paid games if they turn out to be of sufficient quality).

Subscription gaming services

Game services will continue to be a priority for companies, which will also affect the potential popularity of new projects. Because the very format of game services requires regular content additions and long-term attention from players, they have less time to get to know new projects. For the same reason, the number of new game services will not grow rapidly: players’ time is limited and they tend to stay in their favourite games (where many of them also have friends) rather than going to new similar projects or dividing their time between several similar games. Thus, on the one hand, the problem of oversaturation of the game services market may soon arise. On the other hand, it could encourage developers to innovate and look for new gameplay formulas instead of simply copying successful projects.

As for game subscription services, although experts predict an increase in the number of users, Newzoo analysts believe that the growth of this sector as a whole will slow down over the next 3 years. Indie developers have become less willing to make deals with subscription service owners. It can be difficult to predict how successful a project will be – especially games from small independent studios that can’t afford to spend on advertising and promotion. And it is often the case that a “shot” game can earn much more from sales than from being added to the subscription. This is also true of larger independent studios, whose financial well-being depends almost entirely on the success of a single project.

Baldur’s Gate 3, released last year, is a great example of a success that was unexpected even by the developers themselves. The game won many awards (5 Golden Joystick Awards in various nominations, 6 The Game Awards, including Game of the Year, etc.) and sold several million copies. Sven Vinke, head of the development studio, stated that the game will not appear in subscription services.

Baldur’s Gate 3, released last year, is a great example of a success that was unexpected even by the developers themselves. The game won many awards (5 Golden Joystick Awards in various nominations, 6 The Game Awards, including Game of the Year, etc.) and sold several million copies. Sven Vinke, head of the development studio, stated that the game will not appear in subscription services.

Nintendo’s new console is coming out

A new Nintendo console is expected to be released in 2024 – along with a 3D Mario game. According to analysts, the company will allow players to use their account from the current console – Switch – to play their favourite projects on the new console.

Popular game genres on PC and consoles

When it comes to game genres on PC and consoles, analysts predict a surge in the popularity of open-world “soulslice” games (projects that borrow gameplay design elements from the Dark Souls series). Another Crab’s Treasure, Rise of the Ronin, Black Myth: Wukong, Enotria: The Last Song and Flintlock: The Siege of Dawn are scheduled for release in 2024. This trend can be attributed to the huge success of Elden Ring in 2022, which is expected to be followed by a major expansion, Shadow of Erdtree.

Evacuation shooters are also riding a wave of popularity, as evidenced by Escape from Tarkov, Hunt: Showdown and Dark and Darker. Other titles in the pipeline include Marathon, Arc Raiders and Exoborne.

Mobile games

There is a consensus among experts that mobile game developers will increasingly start releasing projects on PCs and consoles in 2024. In 2023 (for the second year in a row), the mobile segment saw a slight decline due to stricter privacy policies by platform owners. In 2023, developers began to invest more actively in the development of existing games rather than creating new ones. Experts believe that studios will try to diversify their revenue sources next year.

One way is to release existing mobile games on PC, allowing players to access their favourite projects from different devices. Another is to develop new games for PC and consoles. In this way, mobile game developers can tap into a new segment and bring their extensive experience in attracting and retaining players. Some major developers have already opened new studios to focus on creating games for other platforms.

The impact of privacy policies on the gaming market

Most analysts also agree that privacy policies will continue to influence the state of the mobile games market this year. However, there is another interesting twist for platform holders Apple and Google: due to changes in legislation (EU Digital Markets Act), they now have to allow third-party app stores into their ecosystem.

Microsoft is planning to take advantage of this, and many analysts believe that it will launch its mobile app store on Android as early as 2024 (it will appear on Apple’s ecosystem a little later). After completing its acquisition of Activision Blizzard last year, Microsoft acquired King, whose portfolio includes one of the most popular mobile franchises, Candy Crush. Opening its own app store will be a profitable initiative for the Xbox division, allowing it to more actively exploit the potential of cloud gaming and provide mobile devices with access to games from the Xbox Game Pass subscription service.

VR games

Statista predicts that the AR and VR market will be worth $38.6 billion by 2024. While AR is most in demand in the manufacturing industry, VR technologies are being developed most actively in the gaming industry.

While interest in VR gaming has cooled somewhat since the pandemic, last year saw the release of new virtual reality devices (such as the PlayStation VR 2). Virtual reality projects have continued to emerge, with a number of releases planned for this year, including Skydance’s Behemoth, Into the Radius 2, Bootstrap Island, CONVRGENCE, Wanderer: The Fragments of Fate Remake, The Burst, Stranger Things VR and more.

Neural networks in game development

Most experts believe that by 2024, game companies will be actively incorporating neural networks into their development processes. While this topic has caused a lot of controversy and concern over the past year, many studios are already using AI technologies in their work and are likely to rely on them more and more in the near future.

However, we should not expect any major changes in game production in 2024: the use of neural networks will be limited to tried and tested scenarios and the creation of secondary content.

As you can see, the games market, while showing stable growth year on year, is still subject to trends, just like any other market. As trends in the games industry often change faster than the production cycle can be completed, the issue of improving your return on investment is particularly acute. One way to increase your chances of financial success is to enter markets in other regions. Logrus IT can help you plan and implement localisation into other languages: the company can offer you many years of experience in this field, as well as a deep understanding of the gaming industry.